龍谷大学 You, Unlimited

Need Help?

Yunus Social Business Research Center (YSBRC)

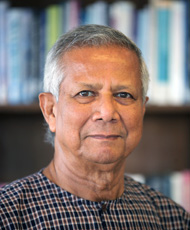

Prof. Muhammad Yunus

Profile

He was born as the second son of a jeweler in Chittagong in southern Bangladesh, which was under British rule at the time. After graduating from Chittagong College, he completed his MA at Dhaka University. After receiving a Fulbright scholarship to study in the U.S., he obtained his PhD in economics from Vanderbilt University in 1969.

Together with friends from his home country, he founded the Bangladesh Civil Committee in Tennessee to support the independence of his country. From 1969 to 1972, he served as assistant professor of economics at Middle Tennessee State University. In 1972, the year after Bangladesh won its independence, he returned to his country and assumed the deanship of the Department of Economics, Chittagong College.

The plight of poor people caused by the severe famine of 1974 led him to engage in relief efforts. In 1976, he launched a poverty alleviation project in the village of Jobra. Serving as a guarantor for citizens of the village, he encouraged banks to grant loans, but his efforts were in vain. This led him to establish Grameen Bank in 1983.

Under Bangladeshi government law, this project has been turned into an independent bank (a government-certified special bank). The bank has greatly contributed to alleviating the country’s poverty through a nationwide rollout of microcredit (unsecured, small loans) as a means of supporting the independence of poor citizens in rural areas. This serves as a model for many international organizations and NGOs in providing support, and it is said that more than 100 million people around the world benefit from microcredit.

As a result of his commitment to such support for poor citizens in becoming financially independent, Prof. Yunus has been recognized by 93 awards so far, including the Nobel Peace Prize (2006) and the Ramon Magsaysay Award, often called “Asia’s Nobel Prize” (1984).

Drawing international attention as a new measure against poverty, microcredit is spreading mainly in developing countries. Operating in a wide variety of fields, Grameen Bank has developed into a group called the “Grameen Family.”